All Categories

Featured

Table of Contents

They typically provide an amount of insurance coverage for much less than long-term sorts of life insurance policy. Like any kind of plan, term life insurance coverage has advantages and downsides depending upon what will certainly function best for you. The advantages of term life include affordability and the capacity to personalize your term size and insurance coverage quantity based on your needs.

Depending on the sort of plan, term life can provide set premiums for the entire term or life insurance policy on level terms. The death advantages can be dealt with. Because it's an economical life insurance policy item and the payments can remain the same, term life insurance coverage policies are popular with young people simply beginning, households and individuals that want security for a certain duration of time.

Term Vs Universal Life Insurance

Fees mirror plans in the Preferred Plus Price Course concerns by American General 5 Stars My representative was very experienced and valuable in the process. July 13, 2023 5 Stars I was pleased that all my needs were fulfilled promptly and expertly by all the reps I spoke to.

All paperwork was electronically finished with accessibility to downloading and install for individual documents maintenance. June 19, 2023 The endorsements/testimonials presented must not be construed as a recommendation to buy, or an indication of the worth of any kind of item or solution. The testimonials are real Corebridge Direct customers that are not affiliated with Corebridge Direct and were not provided compensation.

1 Life Insurance Policy Data, Information And Sector Trends 2024. 2 Price of insurance rates are figured out utilizing methodologies that vary by business. These rates can differ and will usually enhance with age. Prices for active employees might be different than those available to terminated or retired workers. It is very important to look at all variables when reviewing the general competition of prices and the worth of life insurance policy coverage.

Premium What Is Level Term Life Insurance

Nothing in these products is intended to be recommendations for a specific situation or individual. Please speak with your very own consultants for such guidance. Like the majority of group insurance plan, insurance policy plans offered by MetLife contain specific exemptions, exceptions, waiting durations, reductions, restrictions and terms for maintaining them active. Please contact your benefits manager or MetLife for prices and complete information.

For the most component, there are 2 kinds of life insurance policy intends - either term or irreversible strategies or some combination of both. Life insurers use numerous types of term strategies and standard life plans along with "passion delicate" items which have become much more widespread since the 1980's.

Term insurance coverage gives protection for a specific duration of time. This duration can be as brief as one year or provide protection for a details number of years such as 5, 10, twenty years or to a defined age such as 80 or sometimes approximately the oldest age in the life insurance policy mortality tables.

Specialist What Is Direct Term Life Insurance

Presently term insurance rates are really affordable and amongst the most affordable traditionally knowledgeable. It must be noted that it is a commonly held idea that term insurance is the least costly pure life insurance protection available. One requires to evaluate the policy terms meticulously to choose which term life alternatives appropriate to satisfy your particular situations.

With each new term the premium is increased. The right to renew the policy without evidence of insurability is an essential advantage to you. Or else, the danger you take is that your wellness might weaken and you might be not able to obtain a plan at the same rates and even whatsoever, leaving you and your recipients without coverage.

The size of the conversion duration will certainly vary depending on the type of term policy purchased. The premium price you pay on conversion is normally based on your "existing obtained age", which is your age on the conversion date.

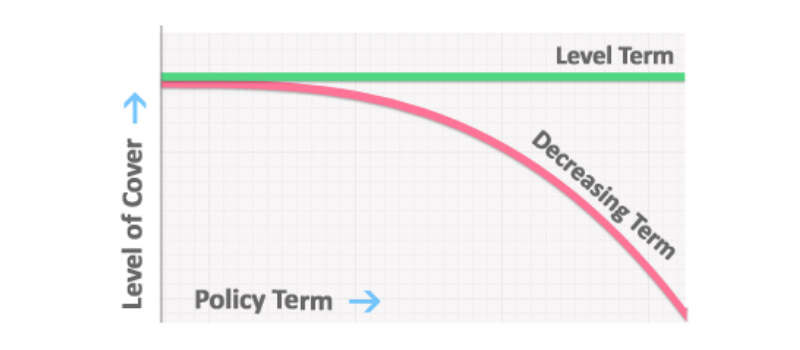

Under a level term policy the face quantity of the policy remains the same for the whole duration. With lowering term the face amount decreases over the period. The costs stays the very same each year. Commonly such policies are marketed as home loan protection with the quantity of insurance decreasing as the balance of the home mortgage decreases.

Typically, insurance firms have not had the right to alter premiums after the plan is sold (short term life insurance). Given that such plans might proceed for years, insurance providers have to use conservative mortality, rate of interest and expenditure rate estimates in the premium computation. Adjustable costs insurance policy, nevertheless, allows insurers to supply insurance coverage at lower "existing" premiums based upon less conservative assumptions with the right to transform these premiums in the future

Which Of These Is Not An Advantage Of Term Life Insurance

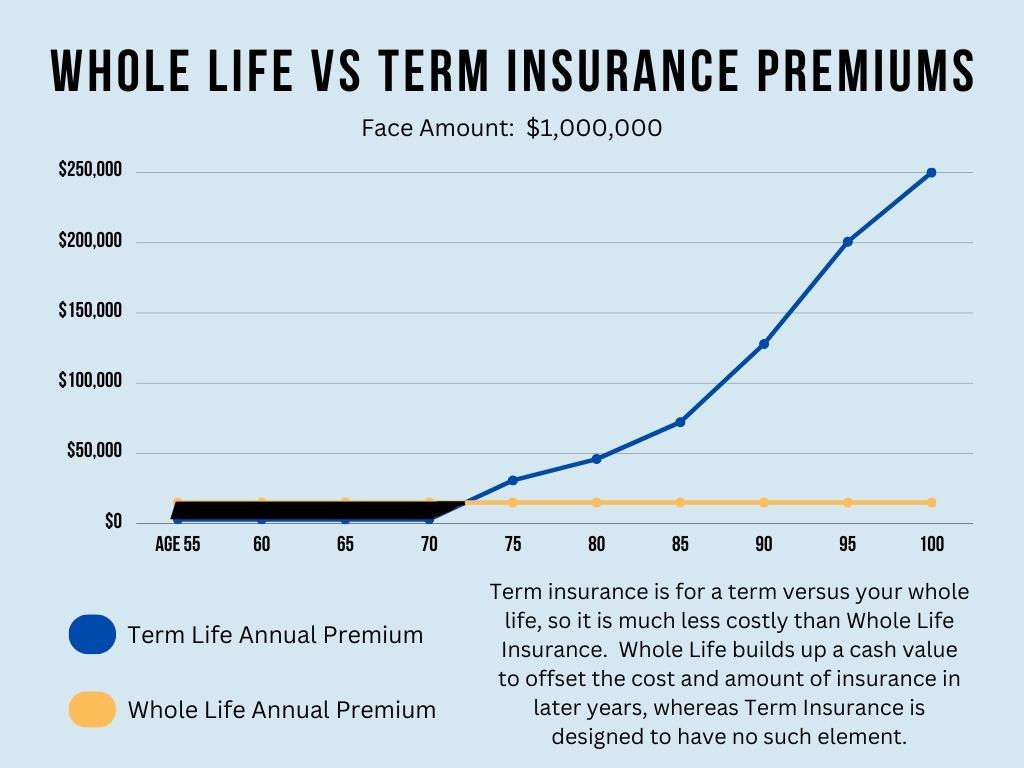

While term insurance coverage is created to give security for a specified amount of time, permanent insurance is made to supply protection for your whole lifetime. To maintain the costs rate level, the costs at the more youthful ages goes beyond the real cost of protection. This additional premium constructs a book (cash worth) which assists pay for the policy in later years as the expense of protection surges over the premium.

Under some plans, premiums are required to be paid for a set variety of years. Under various other policies, costs are paid throughout the policyholder's life time. The insurance provider spends the excess costs dollars This sort of plan, which is sometimes called cash money value life insurance policy, produces a cost savings component. Cash values are critical to a permanent life insurance policy.

Term Life Insurance With Accidental Death Benefit

In some cases, there is no correlation in between the size of the cash worth and the costs paid. It is the money worth of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Standard Ordinary Death Table (CSO) is the current table used in computing minimum nonforfeiture values and policy books for average life insurance policies.

There are two fundamental groups of permanent insurance coverage, typical and interest-sensitive, each with a number of variations. Conventional whole life plans are based upon long-lasting quotes of expenditure, rate of interest and death (short term life insurance).

If these price quotes transform in later years, the firm will readjust the premium as necessary yet never above the maximum guaranteed costs stated in the policy. An economatic whole life plan offers for a fundamental amount of taking part entire life insurance policy with an added supplementary insurance coverage provided through using dividends.

Since the premiums are paid over a much shorter period of time, the costs payments will be more than under the entire life plan. Single premium entire life is minimal payment life where one large exceptional repayment is made. The plan is totally compensated and no more costs are required.

Latest Posts

New Funeral Expense Benefit

Life Insurance Funeral

Affordable Final Expense Insurance